Battery Storage Optimisation

Harnessing machine learning and a market leading trading team

Limejump is a UK market leader in the intelligent optimisation of battery assets, with experience second to none. Utilising our intelligent platform and world leading trading team, Limejump’s agility ensures customers’ assets are ready and primed for dispatch into wholesale and ancillary markets – simplifying access to complex and volatile markets.

Who we work with

Limejump collaborates with a growing number of battery asset owners, infrastructure funds, strategic investors and independent developers. Our intelligent platform optimises assets ranging from 1MW to 100MW in size, in varied locations throughout the UK.

Why Limejump?

Limejump provides an end-to-end approach, tailored to the needs of each and every customer, working with them from project inception all the way through to asset maintenance. Our experienced commercial team’s industry insight enables us to help design successful business cases to move projects forward, supporting customers with investment and security of project delivery. Our in-house Engineering team are on hand to help customers at the very beginning of a project, at design and build phase, through to the ‘go-live’ day and beyond, ensuring the asset is well maintained and optimised to its full potential.

Creditworthy

Limejump is a wholly owned subsidiary of Shell, enabling us to post sufficient collateral to all relevant exchanges when optimising customer assets.

Revenue & performance

Limejump assets have been some of the best performing in the flexibility markets.

End-to-end solution

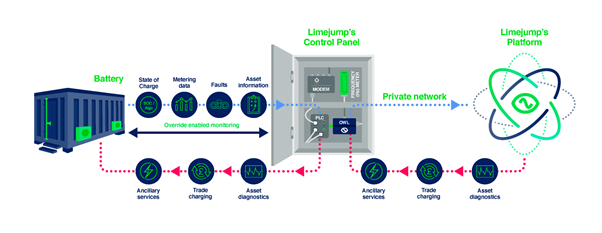

Limejump’s in-house Engineering and Tech teams safely manage asset control and integration, supporting speedy project delivery from asset build to ongoing asset optimisation.

Our platform

Limejump’s platform directly controls customers’ assets to bid, offer, schedule and dispatch in flex markets.

How we optimise a battery

How we optimise battery revenue

Limejump’s platform possesses some of the most sophisticated algorithmic forecasting developments in the battery storage and renewable space. Combining this with automated scheduling optimisation and our world leading trading desk, Limejump optimises battery assets in all available markets, maximising revenue for customers.

Wholesale Trading

Limejump has been a licensed electricity supplier since 2015, gaining direct access to all relevant wholesale power markets:

– Forward OTC markets for all trades from Day Ahead +1 onwards.

– Day Ahead hourly, half-hourly and intraday auctions through EPEX.

– Within day power markets on the EPEX Intraday exchange.

Limejump offers this service to all battery customers, removing the barriers of entry into these markets by posting all collateral requirements – mitigating the risk.

The Balancing Mechanism

The Balancing Mechanism (BM) is the primary market used by National Grid to balance the UK’s power supply and demand in real time. This is to respond to events including power station trips, demand surges and intermittent renewable generation.

Limejump’s agile platform directly controls customers’ assets to bid, offer, schedule and dispatch in the BM on a minute by minute basis.

Ancillary Services

National Grid procures ancillary products to stabilise frequency, ensuring that supply and demand are balanced in real time to keep system frequency as close to 50Hz as possible.

Limejump operated its first ancillary service contract back in 2016, and continues to provide access to the current and exciting development of the ancillary services suite that National Grid is launching:

Dynamic Containment (DC)

Dynamic Containment is a new product used by National Grid. It is a fast-acting post-fault service to ensure frequency remains within the statutory range of +/-0.5Hz in the event of sudden demand drop or supply surge on the grid. This is best suited to fast reacting batteries that can share performance data with National Grid in real time.

Firm Frequency Response (FFR)

FFR is a real time continuous frequency balancing service, delivered by both our Battery & Peaker customers. This balances frequency deviations on a minute-by-minute basis.

Capacity Market

This market is for those that have a generation asset that can increase generation within a four-hour notice period. Under this scheme, participants are paid an availability payment for being connected. New build generators can apply for a 15-year contract in the T-4 auction while existing generators or those able to reduce demand can apply for a one year contract in the T-1 auction. The price paid is determined by an annual auction hosted by National Grid.

There are strict rules to prequalify and meet the various milestones required to participate in the Capacity Market. These are designed to protect the requirements set for this market and ensure the delivery of the contracted amounts. Limejump has a proven track record in managing and qualifying in this process on behalf of our customers.

Contact us

Limejump’s team is on hand to to assist you with any Battery & Peaking enquiry. Click the link below, fill in your details and we will get back to you.