Our journey to optimising Europe’s largest battery

Blog

In July, Limejump and Shell announced the energisation of Europe’s largest battery. The 100MW battery is connected to the UK’s National Grid, helping to ensure the grid remains balanced during times of over or under supply. This blog highlights how the project became a reality, Limejump’s role pre, during, and post energisation and our view on the role that batteries will play over the coming years.

From concept to reality

Building Europe’s biggest battery in Wiltshire was the idea of Penso Power, a UK based investor who specialises in funding large renewable energy projects. With the financial backing of China Huaneng Group and a Chinese government-backed investment fund, they required an offtaker to provide a guarantee on the battery returns. Shell and Limejump collaboratively structured a first of its kind deal offering revenue certainty for multiple years leveraging Shell’s strong backing as an offtaker with Limejump’s battery optimisation knowledge. Batteries can compete in a multitude of markets in the UK including ancillary markets, real time wholesale power markets and the Balancing Mechanism. Limejump will optimise the 100MW battery in the market that offers the best returns for Penso, and support for the grid.

A slight delay to proceedings

Limejump’s Engineering team has been instrumental in the energisation of the Minety battery. However, delivering the first project of its kind on European soil has had its challenges, especially during a pandemic.Initially set to go live in January 2021, Covid-19 had a bigger impact to the energisation of the project than initially predicted, not to mention the pending pressure of Brexit of the UK from the European Union which added additional complications. Key materials and equipment, such as the batteries themselves, were coming from across the globe.

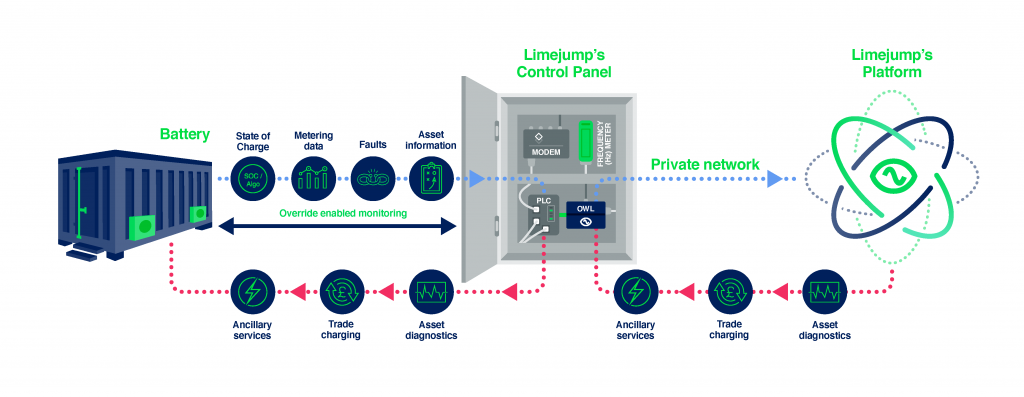

Once all the batteries and related equipment were on site our Engineering team got to work, spending hundreds of hours on site to expedite the battery’s energisation and optimisation. Alongside our intelligent trading and optimisation platform, Limejump offers a truly end-to-end service. This includes installation of our proprietary hardware, which communicates with the batteries management systems, through to our cloud-based software, which then sends and receives commands from the batteries and National Grid. Our Engineering team installed 10 control panels on the site

Connecting to the platform

Our Engineering team designed and implemented the hardware system for the Minety site, which enables us to remotely optimise and automate the 100MW battery into the right market at the right time. This is achieved by installing our control panels directly into the battery’s local controllers. Inside the control panel lives our proprietary hardware, known as an OWL, which sends all data from commands to asset diagnostics to Limejump’s platform via a 4G router. The system is designed with interoperability in mind: it can send & receive data from batteries of various manufacturers, anywhere in the world.

Whilst on site we added value beyond our obligations, offering project partners assistance when they needed it. An example of this was assisting the battery management system provider with the battery’s ‘speed of response’. The batteries full capacity response speed needed to be under 1 second and the management systems needed to meet National Grid’s data requirements of 20hz (sending data 20 times a second) to optimise in the new and future markets, such as Dynamic Containment

Our team has been key to the integration, testing & commissioning of the 100MW battery, assisting project partners throughout all stages of the project.

How to maximise the revenue of Europe’s biggest battery

Due to their short duration, batteries are not an easily ‘hedgeable’ asset in the traditional sense like a gas peaker. A large proportion of battery’s revenue comes from ancillary markets and is also extracted through trading in volatile prompt power markets – providing power when supply is scarce and being a source of demand when markets are oversupplied.

This set of returns is uncertain and is highly complicated to model. Our market leading battery optimisation experience, equating to over 40,000 hours of flexible asset optimisation, coupled with Shell’s balance sheet meant we were able to model the dynamic and ever-changing market and ultimately be comfortable that we could deliver attractive returns to provide a degree of certainty to Minety’s investors.

Minety’s full 100MW capacity will initially be optimised into National Grid’s new Dynamic Containment (DC) product; a post-fault service to ensure frequency remains within the statutory range in the event of sudden demand drop or supply surge on the grid. The Limejump trading team has set the Minety batteries up as Balancing Mechanism (BM) units should extreme prompt market volatility arise. Minety will also be optimised into the Capacity Market (CM), benefiting from guaranteed payments every month in exchange for ensuring sufficient capacity is available.

The newest market on the block

Dynamic Containment (DC) the fast-acting post-fault is the new kid on the block and is best suited to fast reacting batteries that can share performance data with National Grid in real time. There is currently 900MW in the DC market and 100MW of that is the Minety battery. It is proving very popular for the UK’s battery owners and optimisers as it is currently the most profitable, it is a paid as clear auction, which continues to clear at the market cap price due to there being fewer batteries in the service than volume that National Grid are aiming to procure. If the market continues to have a limited number of batteries in it the prices will continue to stay high, however, like the FFR market, we expect prices to fall as more and more batteries come online. This highlights the significance of battery owners selecting an optimiser, such as Limejump, that can stack revenues. It is important to not place all eggs into one basket, especially as DC becomes flooded over the next couple of years. Limejump utilise their tech led automated battery dispatch and a world leading human trading desk, opening the option to bid in wholesale markets in addition to National Grid’s ancillary services.

What the future holds for batteries in the UK

Minety is the biggest battery in Europe, we don’t know how long it will hold that accolade but what we do know is there are lots and lots of similar and smaller sized batteries currently being funded and built in the UK. The UK needs batteries to accelerate the energy transition, renewable generators are being connected to the UK’s grid on a daily basis, leading to a more unpredictable and intermittent source of supply, batteries will help National Grid fill balance the system.

Currently, there is 1.4GW of battery capacity connected to the UK’s grid, nowhere near enough for a 100% renewable energy mix, hence UK’s reliance on Gas Peakers which are a cleaner solution to coal but still not a 100% renewable energy source nor can they dispatch in under a second like batteries. According to National Grid ESO’s FES update this week, the requirements for battery storage has increased by 2GW in all scenarios to 2030, meaning we need a further 12GW of batteries intelligently connected to the grid in the next 8 ½ years.

Limejump are excited to be at the forefront of the UK’s energy transition and look forward to overcoming the energy transitions challenges with intelligent solutions.

Want to learn more?

Limejump is a UK market leader in the intelligent optimisation of Battery & Peaking assets, with experience second to none. Utilising our intelligent platform and world leading trading team, Limejump’s agility ensures customers’ assets are ready and primed for dispatch into wholesale and ancillary markets – simplifying access to complex and volatile markets.

Our Battery Optimisation offering

Speak to a member of our team