Power Purchase Agreements – Turn Market Volatility to your Advantage

Blog

With energy markets requiring ever more complex strategies to derive revenue, Power Purchase Agreements still provide the clearest methodology for trading energy to create a return from renewable resources. However, trading intelligently means taking advantage of inherent market volatility.

Trading on a rollercoaster

Taking a passive approach and living off past experiences do not provide you with that competitive advantage: look to the new and embrace the future. A smart trader uses the most advanced tools to hand, accessing the most accurate information, learns from the past with an eye on the future and can tap into expert market insight.

Knowledge comes from market research. The current pricing climate is changing daily. You can read about the influences that create this market scenario in our earlier blog: five-things-that-influence-power-price. The winter months have provided us with brief glimpses of extreme cold but in general, it has been damp and mild, with lower gas demand in a well-supplied market.

In addition to these factors, the tremors of the Brexit rollercoaster continue to throw the GBP around with each visit to Brussels. With the value of GBP depreciating, the cost of power purchased from Europe as well as the price of fuel commodities like gas and coal being traded in Euro and USD is increasing.

These factors are only set to gain further influence as we see with the Cottam Coal Power Station to cease operations in September, reducing the baseload capacity by up to 2GW, and the decision by Hitachi to not pursue the development of a new Nuclear plant in the UK.

In the same month, large amounts of wind generation entered the market as the Hornsea 1.2GW offshore wind project began delivery. In addition, the UK Government has announced plans to end the use of gas to heat homes, turning to electricity. Replacing this capacity with renewables will lead to increased price variation and the multitude of factors that influence these

The added value of PPA

With these core variables (and many more) in play, an already daunting market can seem impenetrable. In some ways it is. Luckily, a PPA provides you with a route to market and representation by energy experts, if you pick the right partner. The traditional methodology with a PPA allows you to take your generation to market with a price locked in at the time of the agreement. This provides price certainty and protects against market price drops. However, the static nature of a fixed contract means that you miss the chance to potentially lock in at much higher prices created by market volatility.

If you watch the market and discuss your options with trading experts who are using advanced machine learning to improve forecast experience, these tools can exponentially improve the price you lock in at.

For those who wish to reduce their exposure to risk, partially hedging your volume by combining the ability to allocate specific volumes of your generation capacity to lock in prices, then using your remaining capacity at a time when you have tracked the market adequately and when the price is right for you, can reward generation in dividends. Setting a risk strategy with your PPA supplier creates that plan that can optimise your asset investment.

This methodology is sometimes called Clip Trading and allows generators to mix and match their hedging strategy in a similar way a coal power station would execute. This advanced trading ability takes advantage of a volatile market, analysis and technology and can provide you with a mix of security and flexibility to deliver your trading objective.

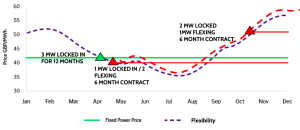

To illustrate, you can take a 6MW generating asset and allocate 3MW locked in at a fixed price in March.

You can then track the market changes and decide to lock 1MW more at a price in May in a 2-month flexible contract. Continue to track the market and when prices rise again at the beginning of winter, you can lock 2MW into a fixed 6-month contract and the last 1 MW with a 6-month flexible contract.

Managing time and risk

Spreading your decision making manages both your risk across time or potential market changes while providing you with the intelligent market forecasting insight and a wealth of experience throughout the year, under your belt. This variation allows you to embrace security while walking a little on the wild side, rewarding a sophisticated trading style.

This is not the only new market change coming as promising developments such as Project TERRE, Corporate PPA’s, increased local supply and demand are all set to play a part within the vibrant energy trading world in the future.

The key is talking with experts who have a grasp of the realities of the market, and the latest in trading techniques to help you make the correct trading decision.

However, the methodology of creating asset revenue and fulfilling the promise of sustainable generation is out there to utilise for the savvy asset manager.

To find out more, contact Limejump to review your strategy for success.

Disclaimer

This document has been prepared by Limejump and is provided to its recipient on no-reliance basis, free of charge and voluntarily. The data and analysis in this document is owned by Limejump, unless where stated otherwise. The recipient shall not distribute the document to people outside of its organisation. Whilst Limejump has taken reasonable care in preparing this document, no representation or warranty, either expressed or implied, is made as to the accuracy or completeness of the information that it contains. This document does not constitute professional advice, delivery of service or performance of a contractual obligation by Limejump. Parties using information in here should make their own enquiries and obtain independent verification as to its accuracy and suitability for the purpose for which they intend to use it. Neither Limejump nor any other companies in the Limejump group, shall be liable for any error or misstatement or opinion on which the recipient of this document relies and does not accept any responsibility for any costs, damages or losses which may be incurred as a result of the reliance, use or unlawful distribution of this document by its recipient.