An increase in imbalance volume and considerable volatility in the forward market

Market Pulse

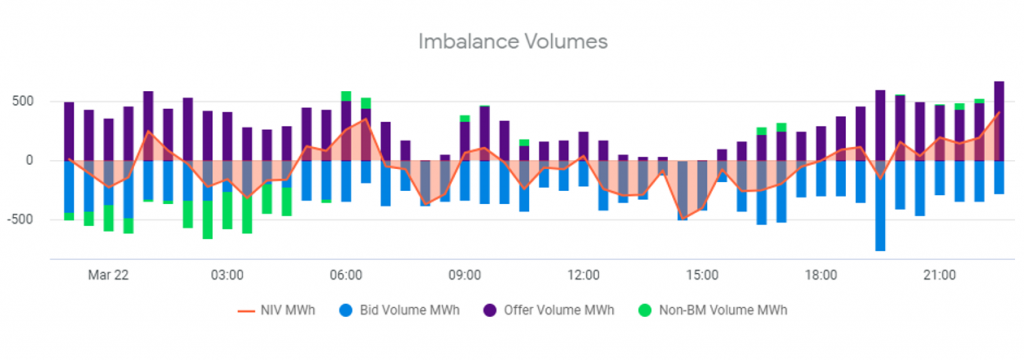

We have witnessed quite a calm week in the prompt U.K. power market. Healthy levels of wind and solar generation, combined with a solid base of Nuclear resulted in a well-balanced system. We have noticed that the shift in seasons to Spring is starting to have an impact on the market. The evening demand peak is slightly later now, closer to 7pm, due to milder weather. There is also a slight increase in imbalance volume and intra day volatility due to the increase in generation from wind and solar, see graph below. Wind and Solar are more intermittent and produce varying levels of supply, which can crash or spike at any moment creating more of an effect on imbalance volumes and therefore market price.

In terms of the forward market, we have seen considerable volatility, with a drop and then a rise in the UK Baseload Summer-21, leading to Wednesday’s prices peaking above last week’s high of £56.25/MWh. This has been brilliant for our PPA generators who have locked in these high prices during these volatile conditions. A £1 move in the baseload forward price can be worth over £10,000/year for some generators. Carbon prices have dropped slightly by just over €2, but are still very high. Cold weather forecasts for April and the current blockage of the Suez Canal have been cited as reasons for an increase in gas prices. Around 12% of global trade travels through the Suez Canal, including European imports of LNG. For the time being this isn’t too much of a concern regarding the impact this will have on gas prices, however, it has announced that ‘it might take weeks’ to refloat the cargo ship that is currently blocking passage. If this is the case, it could have a significant impact on gas and power prices.

Coal continues to close down

This week, EDF announced the closure of their West Burton coal-fired power station by September 2022. This follows a similar announcement by Drax at the beginning of March, leaving only the 2GW Ratcliffe-on-Soar continuing to generate power from coal after 2022. Similar to Drax, West Burton will be available over the next 18 months but only to meet its capacity market commitments. The UK’s ‘coal phase out date’ has been brought forward to 2024, which means the market will have to continue to adapt to maintain balance within the system.

Thomas McGoldrick, a Limejump Business Development Manager commented:

“Earlier in the year we saw extreme volatility within Balancing Mechanism prices reaching £4,000/MWh, due to tight market conditions. The closure of West Burton and Drax could potentially exacerbate market tightness in the future. Overall it’s clear that there will be an increasing necessity for gas peakers and batteries to provide support for National Grid as we transition towards net zero.”

While there is increasing growth in both the gas peaking and battery developments, we are still far from meeting the capacity required during extreme peak events should intermittent renewable generation underperform. Overall the picture is positive for carbon reduction but the question remains open on how to balance the Grid during extreme periods, such as those we saw in January 2021.

Outlook for next week

High winds are the main story for next week, with wind significantly ramping up from the 25th March. Based on forecasts we could even see a new record, possibly reaching 17.5GW. High wind forecast, as well as increased availability in CCGT’s and Nuclear by 400MW and 300MW respectively, means that the UK power system is looking very well supplied for next week.