High winds and record breaking carbon prices create exciting week

Market Pulse

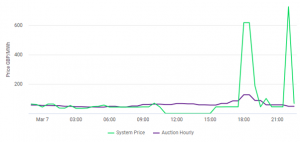

Last weekend, a combination of cold temperatures and low winds saw system prices sky rocket to £725/MWh. Wind generation was around 2GW, whereas the seasonal norm is closer to 10GW, creating market volatility.

Since the weekend, wind has been ramping up, reaching highs of 15GW, which led to suppressed prices for the week. The stormy weather in the early hours of Thursday morning resulted in negative system prices of -£61/MWh.

Further reductions on the reliance of coal

Drax has announced an end to their coal generation with units 5 and 6, both 645MW, no longer operating in wholesale dispatch by the end of the month. These power plants are still available, and are still offered in the Balancing Mechanism (on Wednesday 10th March at £4000/MW). Drax announced that the formal closure of these plants will occur on September 2022, at the end of their existing Capacity Market Obligations. Drax planned to turn these units into Europe’s biggest Gas plants, but have since abandoned this plan following opposition from environmental groups. This will reduce the maximum wholesale availability of Coal to only 4GW (Ratcliffe-on-Soar 1 to 4 and West Burton 1 to 5) by the end of March. These closures are further accelerating the extinction of Coal generation in the UK ahead of the 2025 deadline.

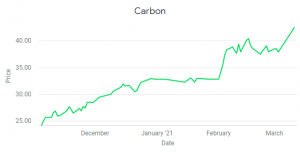

Carbon prices hit record levels

On Wednesday, Carbon traded up to all time highs with EU Allowances (EUA’s) reaching €42.4/tonne. EUA’s is a form of carbon allowance used as the main currency in the EU Emissions Trading Scheme. There seemingly aren’t any fundamental drivers for this new record level, as there hasn’t been any major changes in supply or demand. However, this rise in price seems to be the result of strong auction results and the agreement of the $1.9tn Covid Relief stimulus package in the US.

Outlook for next week

Next week, the system is looking slightly short despite improvements in Biomass, CCGT and Nuclear availability. This is because wind is forecast to drop below seasonal norms, closer to 5GW. There is also a risk of a slight cold snap resulting in temperatures also dropping below seasonal normal levels but this is looking marginal.